PayPal Orders V2: Upgrade to your Business

With PayPal Orders V2 you connect with buyers from all over the world and enable them to pay the way they want to pay. With a simple, single integration your customers benefit from an improved shopping experience thanks to the new "Pay Later" options – including continuous updates and innovations.

Giving customers

buying power

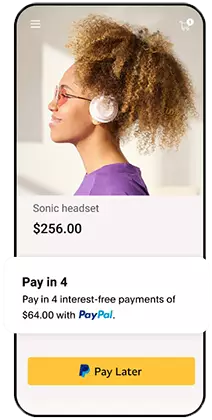

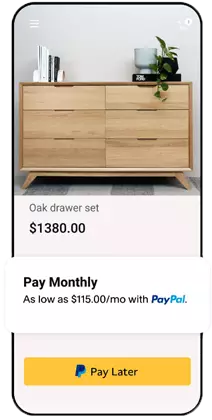

PayPal’s Pay Later offers are included in PayPal Orders V2. Pay Later gives shoppers the flexibility to pay for purchases over time. When you offer Pay Later, your customers can choose a payment schedule that works for them through Pay in 41 or Pay Monthly2. With PayPal Orders V2 you can place the "Pay later" button directly on your product detail pages, in the shopping cart or in the checkout in order to inform your customers earlier in the purchase process.

Simple

Migration

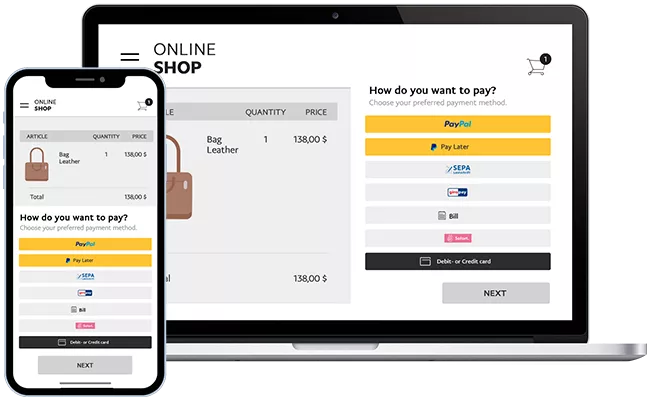

To switch to PayPal Orders V2, you only need to request new credentials from PayPal and submit them to us. In the chapter 'Configuration for PayPal' of our online documentation, you will find details about the process. Then place the PayPal Smart Button script at the desired location in your online shop (checkout, product page, shopping cart page). Please refer to the documentation chapter 'PayPal Smart Button' for details.

Fraud prevention

& Seller protection

We use intelligence from our two-sided network, machine learning, and analytics to help protect your business from existing and evolving threats. We can also help your business avoid chargebacks, reversals, and fees on eligible sales – even when you're facing a customer dispute. Limits apply.

PayPal Shortcut (Express)

With one click, your customers can go directly from the product page or the shopping cart to the PayPal payment page without any detours. The financial data and shipping details are taken over so that customers do not have to re-enter them on your website.

Improved usability

For your customers: In the payment process, an inline flow opens in an overlay window, providing your customers with a smooth payment experience – without the need to open a new tab.

Latest technology

With PayPal Checkout, you use the latest technology and always stay up-to-date through continuous updates and innovations.

Benefit twice from PayPal Orders V2 with the Computop Settlement File

With a PayPal connection via Computop Paygate, all payments are also included in the Computop Settlement File (CTSF). This central settlement file makes it much easier to reconcile incoming payments; this also applies to using the new interface PayPal Orders V2.

Give your sales a boost with Pay Later at no additional cost to your business

Help increase sales by offering Pay Later options to your customers – at no additional cost to your business. Pay Later allows customers to pay over time while you get paid up front. Businesses with pay-over-time messaging on their site have seen their average order value increase by up to 56%.3 Pay Later offerings from PayPal come as part of a merchant’s PayPal Orders V2 integration.

Pay in 4

With Pay in 4, customers pay off their purchase in four bi-weekly, interest-free payments while you get paid in full.

Pay Monthly

Pay Monthly gives customers predictable monthly payments at varying APRs. Don’t worry – you still get paid in full.

PayPal is one of the world’s most preferred, trusted, and familiar brands

years

of experience

different

currencies

markets

around the globe

years

of experience

different

currencies

markets

around the globe

Fast integration: PayPal via Computop Paygate

On our product page, you can find further information and helpful links on integration, features, and worldwide availability of PayPal via Computop Paygate.

PayPal »Pay Later« offers you numerous advantages:

39%

PayPal's Pay Later options are increasing cart sizes by 39%.4

62%

of users say that seeing buy now, pay later messaging while shopping encouraged them to complete a purchase.5

74%

of buy now, pay later users are more likely to shop at a merchant again if they offer a buy now, pay later option.6

About PayPal

Regardless of the size and type of your company, PayPal offers suitable solutions for a wide variety of payment transactions. From online transactions on the website to on-site contactless payments, merchants are always one step ahead with PayPal. With just one business account, you can easily access all PayPal products and services.

So you always have an overview of your payment processes, benefit from improved risk management and accelerate the growth of your online business. It is not for nothing that PayPal is one of the best-known and most popular providers of digital payments. Today, PayPal connects over 400 million consumers worldwide with retailers from more than 200 markets. For more information, visit paypal.com.

1 About Pay in 4: Loans to California residents are made or arranged pursuant to a California Financing Law License. PayPal, Inc. is a Georgia Installment Lender Licensee, NMLS #910457. Rhode Island Small Loan Lender Licensee. When applying, a soft credit check may be needed for some consumers, but will not affect their credit score.

2 Pay Monthly is subject to consumer credit approval. 9.99-29.99% APR based on the customer's creditworthiness. PayPal, Inc.: RI Loan Broker Licensee. The lender for Pay Monthly is WebBank.

3 Average lift in overall PayPal AOV for merchants with PayPal Credit messaging vs. those without, 2019 PayPal internal data.

4 PayPal Q2 Earnings-2021

5 TRC online survey commissioned by PayPal in April 2021 involving 5,000 consumers ages 18+ across US, UK, DE, FR, AU (among BNPL users, US (n=282), UK (n=303), DE (n=342), AU (n=447), FR (n=255)).

6 TRC online survey commissioned by PayPal in April 2021 involving 1000 US consumers ages 18+ (among BNPL users, n=282).