The German launch of Click to Pay has been announced for summer 2021. Find out below what exactly is behind the new solution, how it works from the customers‘ point of view, what benefits you as an online merchant can expect from integrating it into your store, and what you have to do for this.

At a glance

- Click to Pay is best described as a digital wallet for credit and debit cards. The solution is provided jointly by the card companies (schemes) organized in the EMVCo association – Visa, Mastercard, American Express, Discover, JCB, and China Union Pay.

- Thanks to automatic recognition of the end device used, consumers can immediately access all their stored cards in the check-out of an online store and complete the purchase quickly and with just a few clicks in most cases.

- Click to Pay is also designed as an express check-out solution. Like PayPal, the customer’s billing and delivery address are stored directly in the wallet and transferred to the merchant’s store back end. This feature makes the solution ideal for guest check-out.

Why is Click to Pay being introduced?

Is Click to Pay merely a late reaction to the market success of established, successful wallet systems? Credit card companies can react calmly to such questions. A closer look at the technical implementation reveals that Click to Pay is not just a simple copy of PayPal.

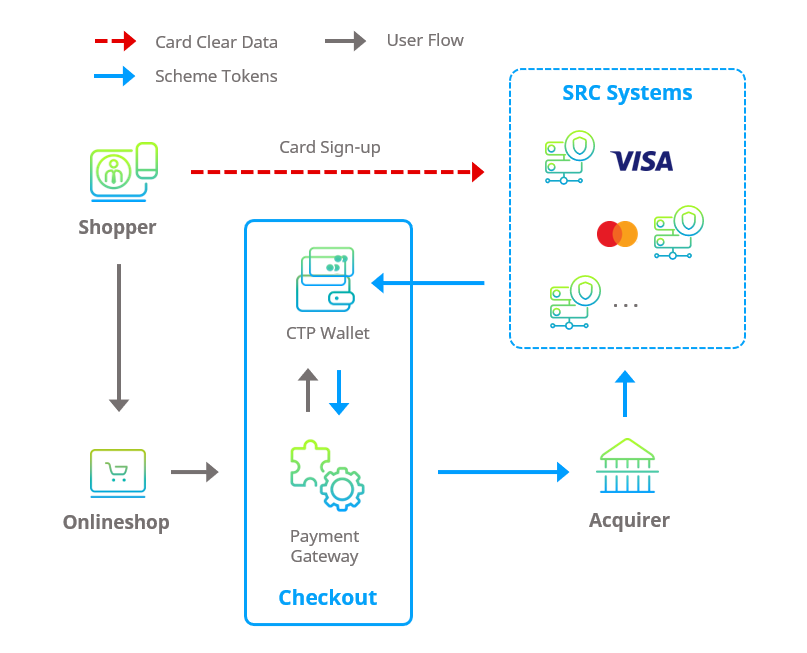

The technical basis for the development of the new payment solution is the Secure Remote Commerce Standard (SRC) of EMVCo, the international association of the six leading credit card companies. This association is responsible for developing globally applicable technical standards for credit card payments, such as the rules for the 3-D Secure 2 protocol.

The requirements of the Secure Remote Commerce Standard for online card payments in the future can be outlined as follows:

- Online payments by credit and debit card should become more secure for consumers and merchants and achieve authorization rates similar to those in brick-and-mortar retail. EMVCo wants to accomplish this goal by keeping the customer’s card data – such as the card number (PAN) and expiration date – out of the payment process. Instead, the physical card with all its sensitive data will be replaced by a kind of digital, token-based payment identity that is better protected against fraud and that cardholders can access quickly and easily when shopping online.

- Check-out for card payments in online retail should result in as few clicks and data entries as possible to reduce premature purchase abandonment. Equally noteworthy is the credit card companies‘ commitment to providing a consistent solution from the end user’s perspective. Regardless of whether the online shopper has cards from Visa, Mastercard, American Express, or cards from all three brands, all the cards used must be accessible via the Click to Pay wallet.

Increased security thanks to scheme token technology

Click to Pay is based on the use of scheme token technology. In this process, real card data is replaced by tokens, i.e., card pseudonyms. As soon as a user loads a new card into his virtual card wallet, it is immediately exchanged for a token from the corresponding card company (Scheme).

As a result, neither the online store nor the store’s payment provider or the acquirer needs to come into contact with the real card data. Instead, only the token, which is worthless to cybercriminals, is passed on to the relevant card company.

How does Click to Pay work?

Signing up new cards

Shoppers who want to use Click to Pay in online shopping must register their cards once in the wallet. Three options are available for this: A) Registering the card directly via the card-issuing bank (issuer) in online banking; B) Registering the card via an online registration page with the relevant card company; C) Registration of the card directly in the check-out process at the online store in question.

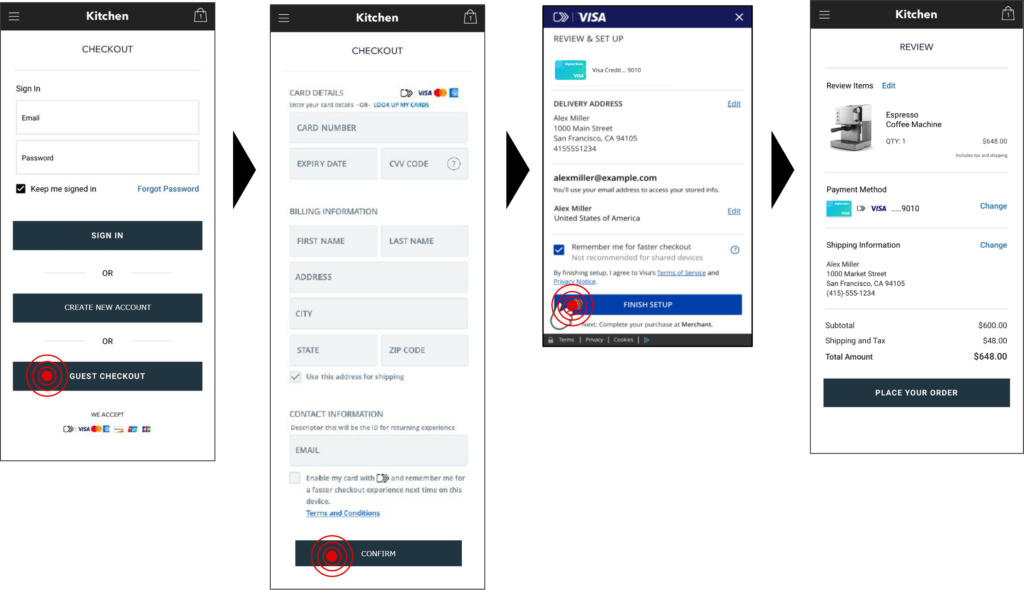

Case 1: First purchase with Click to Pay and registration of a card directly in the check-out.

In an online store that offers Click to Pay as part of guest check-out, the customer proceeds to the check-out.

Since he is using the solution for the first time and has not yet registered any cards, the input field for registering new cards appears automatically. Here, he enters his card data, stores a billing and delivery address for the card, and specifies an e-mail address that serves as a user ID. Also, he can give his consent for a device ID to be transferred to the system to identify his end device. The stored device ID allows automatic recognition for subsequent purchases on the same device (see next use case).

In our example, the buyer uses a Visa card. By clicking the „Confirm“ button, the store’s payment service provider therefore automatically contacts the Visa Click to Pay server to store the specified card there.

After successfully verifying the card, it is now deposited in the wallet, and the customer can complete the purchase.

Case 2: Customer with registered cards makes purchase with a known end device

Click to Pay shows its full strength in the following use case: A customer makes another purchase with Click to Pay, using the same device that he used to register cards. Now the automatic device recognition comes into play.

During the initial card registration, a device ID was created in the Click to Pay system, which is now recognized. If a card that matches the device ID is stored with a card company, the card company returns the card information to the store’s payment service provider in the form of a token. The provider then renders a list of all available cards to the customer.

After the customer selects his Visa card again for the purchase – as in our previous example – he can complete the purchase with just one more click, i.e., without providing any further data and usually without additional authentication measures.

This smooth user experience is not limited to shopping in the same store: If the customer visits another store that supports Click to Pay via the same device, the check-out process can be carried out in the same way.

Case 3: The customer already has cards in the wallet, but uses a new end device

If the customer uses a new device for the purchase, no device ID can be transferred to the system, and therefore no automatic identification can take place. The user must therefore register once with the device in the Click to Pay wallet.

On the standard form that appears for registering new credit cards, the user selects „Look up my cards“ and enters his stored e-mail address. He receives a one-time passcode (OTP) by e-mail or SMS, which he uses to authenticate himself. All further steps are analogous to the previous use cases.

What are the benefits for online merchants of integrating Click to Pay

If implemented correctly in the store check-out, Click to Pay offers increased payment convenience for customers who prefer to pay by credit card.

For example, storing all credit cards in the digital wallet eliminates the need to re-enter the CVV code or re-enter card data for each purchase. Automatic device recognition enables customers to make purchases on all regularly used devices in a matter of seconds.

At the same time, occasional shoppers do not need to create a customer account, as payment and address data are already stored in the Click to Pay wallet and transferred to the merchant’s store backend for further order processing.

Another major plus point is Click to Pay’s security architecture. The use of scheme token technology should further reduce the risk of chargebacks and the number of rejected authorizations in e-commerce in the future. Positive effects on the 3-D Secure process can also be expected, as card-issuing banks (issuers) will resort to the „challenge request“ less frequently when using scheme tokens. With the use of Click to Pay, consumers will thus rarely be prompted for additional authentication measures.

How can merchants integrate Click to Pay into their online store?

Merchants who want to offer their customers Click to Pay must first check with their payment service provider whether it supports Click to Pay. Generally, there are two possible types of integration available here:

Integration at the end of the check-out process:

The Click to Pay button is only displayed to the customer when the available payment methods are listed, i.e., after logging into the customer area or entering the additional order data. The actual integration usually takes place via the credit card form provided by the payment service provider or a fully hosted payment page.

Integration at the beginning of the check-out process:

Here, the Click to Pay button is visible right at the beginning of the check-out process. The advantage of this implementation is that especially occasional and one-time shoppers can enjoy the express check-out functionality, as no additional order data needs to be provided. Of course, a combination of both integration methods is also possible.

Click to Pay with Visa

Soon available in Computop Paygate: the new payment solution for your online store. Thanks to Click to Pay with Visa, your customers pay with just a few clicks, even if they shop as a guest without a customer account. Simple, fast, secure!